Are You Mortgage-Ready? What Renters Need to Know

As the housing market evolves, many renters may not realize that they are closer to homeownership than they think. A recent article, “Some renters may be ‘mortgage-ready’ and not know it. Here’s how to tell,” sheds light on this topic and offers valuable insights for those currently renting. If you’re considering the possibility of buying a home, here are a few key takeaways that could change your perspective:

The Renting Landscape

In 2022, approximately 39% of U.S. families were renters, which translates to around 7.9 million households being categorized as income mortgage-ready. This means that their financial situation could comfortably cover mortgage payments, making the dream of owning a home a realistic option for many.

Don’t Fear Your Credit Score

One of the biggest hurdles potential homebuyers face is the fear of checking their credit scores. Many renters worry that even a soft check could negatively impact their score. However, it’s important to note that soft credit inquiries are now commonplace and do not affect your credit score. Taking the time to understand your credit health is a vital step toward making informed financial decisions.

Mastering Your Debt-to-Income Ratio

A significant factor in qualifying for a mortgage is understanding your debt-to-income (DTI) ratio. This metric compares your monthly debt payments to your gross monthly income. Managing this ratio is essential, and it’s worth noting that some loan options, such as FHA and VA loans, allow for higher DTI ratios. This flexibility could enable more renters to qualify for a mortgage, even if they have existing debt.

Conclusion

If you’re a renter wondering about your options for homeownership, it may be time to explore your financial readiness. There’s no harm in reviewing your credit, understanding your DTI, and assessing your overall situation. The journey to homeownership may be more attainable than you realize.

Would you like to dive deeper into this topic? The full article is an excellent resource and can provide you with even more information on how many renters could potentially transition into proud homeowners.

Link to the article: https://www.cnbc.com/2024/07/18/how-renters-can-tell-if-their-finances-are-mortgage-ready.html

Cheers!

Happy New Year! Strong Starts, Stable Rates & VA Construction Opportunities

Happy New Year! As we head into 2026, I want to start by saying thank you to everyone who trusted me with their mortgage in 2025 or

VA OTC Construction Loans

Everything You Need to Know About the VA OTC Construction Loan Building your dream home as a veteran or active-duty service member is more accessible

🚫 Why the FED Rate Cut isn’t Lowering Mortgage Rates

Understanding the Disconnect: FED Rate Cuts and Mortgage Rates For many homebuyers, navigating the current mortgage landscape can feel like walking through a maze. Recent

Are You Mortgage-Ready?

Are You Mortgage-Ready? What Renters Need to Know As the housing market evolves, many renters may not realize that they are closer to homeownership than

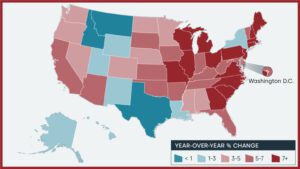

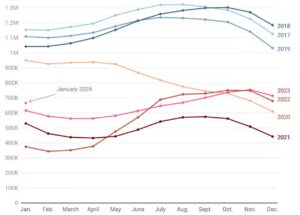

Real Estate Market Snapshot

As we step into the new year, the real estate market in January 2024 exhibited notable trends and shifts, revealing a dynamic landscape for both