Understanding the Disconnect: FED Rate Cuts and Mortgage Rates

For many homebuyers, navigating the current mortgage landscape can feel like walking through a maze. Recent Federal Reserve rate cuts have raised confusion, especially when they don’t always lead to lower mortgage rates. Here’s a quick breakdown to help clarify what’s happening.

1. FED Cuts ≠ Mortgage Rate Drops

It’s crucial to understand that mortgage rates are influenced by long-term economic forecasts rather than the Federal Reserve’s short-term decisions. While the FED’s actions can signal shifts in the economy, they don’t directly dictate mortgage rates.

2. Economic Fears Raise Rates

Interestingly, a significant FED rate cut can sometimes trigger higher mortgage rates. This is often due to concerns about a looming recession. Investors may pull back in anticipation of economic instability, which can lead to increased rates despite the FED’s attempts to stimulate growth.

3. Election Year = Volatility

We’re in an election year, and that means increased market volatility. Homebuyers should prepare for fluctuating rates as political uncertainties play out. Typically, more stable rates can be expected post-election.

4. Strong Job Market

The current robust job market is another factor keeping mortgage rates elevated. A strong employment landscape reduces the need for further rate cuts, as consumers have more confidence in their financial stability. However, the accuracy of job market forecasts can be questionable, adding another layer of complexity.

5. Recession Worries

Recent decisions by the FED, including a larger-than-expected rate cut, have spooked the market. This has led to a rise in mortgage rates as investors react to potential recession risks, demonstrating the complex interplay between FED actions and market sentiment.

6. What Should Buyers Do?

For potential homebuyers, it’s essential to recognize that rates may not improve significantly in the immediate future. Instead of waiting for an elusive drop, many are choosing to secure current rates with the understanding that they can refinance when rates eventually decrease. And history suggests that rates will go down eventually.

Got Questions?

If you’re feeling uncertain about navigating these mortgage dynamics, don’t hesitate to reach out. It’s crucial to stay informed and prepared as the market evolves.

Happy New Year! Strong Starts, Stable Rates & VA Construction Opportunities

Happy New Year! As we head into 2026, I want to start by saying thank you to everyone who trusted me with their mortgage in 2025 or

VA OTC Construction Loans

Everything You Need to Know About the VA OTC Construction Loan Building your dream home as a veteran or active-duty service member is more accessible

🚫 Why the FED Rate Cut isn’t Lowering Mortgage Rates

Understanding the Disconnect: FED Rate Cuts and Mortgage Rates For many homebuyers, navigating the current mortgage landscape can feel like walking through a maze. Recent

Are You Mortgage-Ready?

Are You Mortgage-Ready? What Renters Need to Know As the housing market evolves, many renters may not realize that they are closer to homeownership than

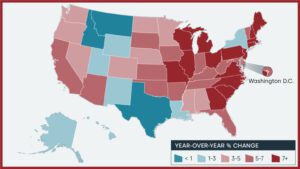

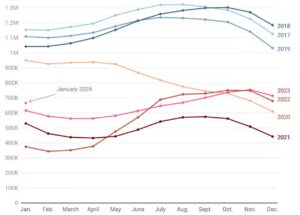

Real Estate Market Snapshot

As we step into the new year, the real estate market in January 2024 exhibited notable trends and shifts, revealing a dynamic landscape for both