In a pivotal decision at its final policy meeting of 2023, the Federal Reserve opted to maintain interest rates within the 5.25% to 5.5% range for the third consecutive meeting. While the rates remained unchanged, the central bank hinted at a potential shift in strategy for 2024, suggesting the likelihood of significant rate cuts. This decision comes against the backdrop of a changing economic landscape and a conscious effort to address inflation concerns.

-

Status Quo Maintained: The Federal Reserve’s decision to leave interest rates untouched reflects a consistent stance, holding steady within the 5.25% to 5.5% range. This marks the third consecutive meeting where rates have remained unchanged, signaling a deliberate pause in the historic rate-hiking campaign that aimed to curb inflation.

-

Shift in Inflation Outlook: Federal Reserve officials, including Chairman Powell, acknowledged a notable shift in the inflation landscape. With inflation showing signs of easing over the past year, the urgency for further rate hikes has diminished. Powell emphasized that rate hikes are no longer the central scenario, a departure from the consensus held just a few months ago.

-

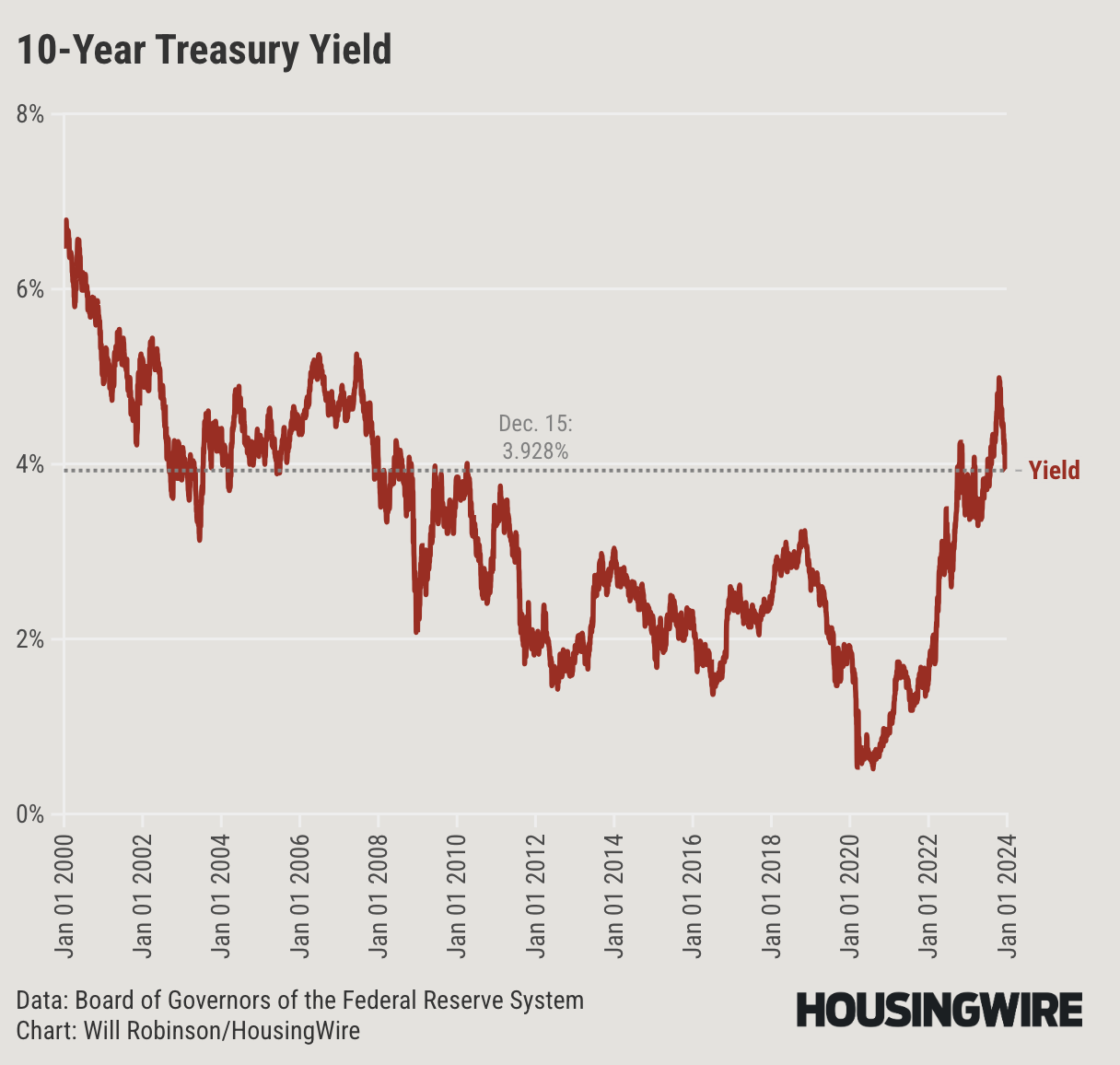

Anticipation of Rate Cuts: Looking ahead, the Federal Reserve provided insights into its future monetary policy direction. A significant number of top officials within the Fed anticipate a series of rate cuts in 2024. The released forecasts indicate that the median projection for December of next year is a target rate of 4.6%, reflecting a 0.75 percentage point decrease from the current rate.

In the dynamic landscape of the economy, predicting its trajectory remains a challenging task. The Federal Reserve’s decision to keep interest rates unchanged while signaling potential cuts underscores the complexity of economic forecasting. As we navigate through these uncertainties, it’s essential to recognize that even the most educated guesses about the future performance of the economy are subject to change, emphasizing the need for adaptive and informed decision-making.