Happy New Year! As we head into 2026, I want to start by saying thank you to everyone who trusted me with their mortgage in 2025 or prior years. 2025 was a great year — we helped over 60 borrowers, including 19 new construction home loans, and I’m incredibly grateful for the relationships built along the way. We offer… Continue reading Happy New Year! Strong Starts, Stable Rates & VA Construction Opportunities

Category: Interest Rates

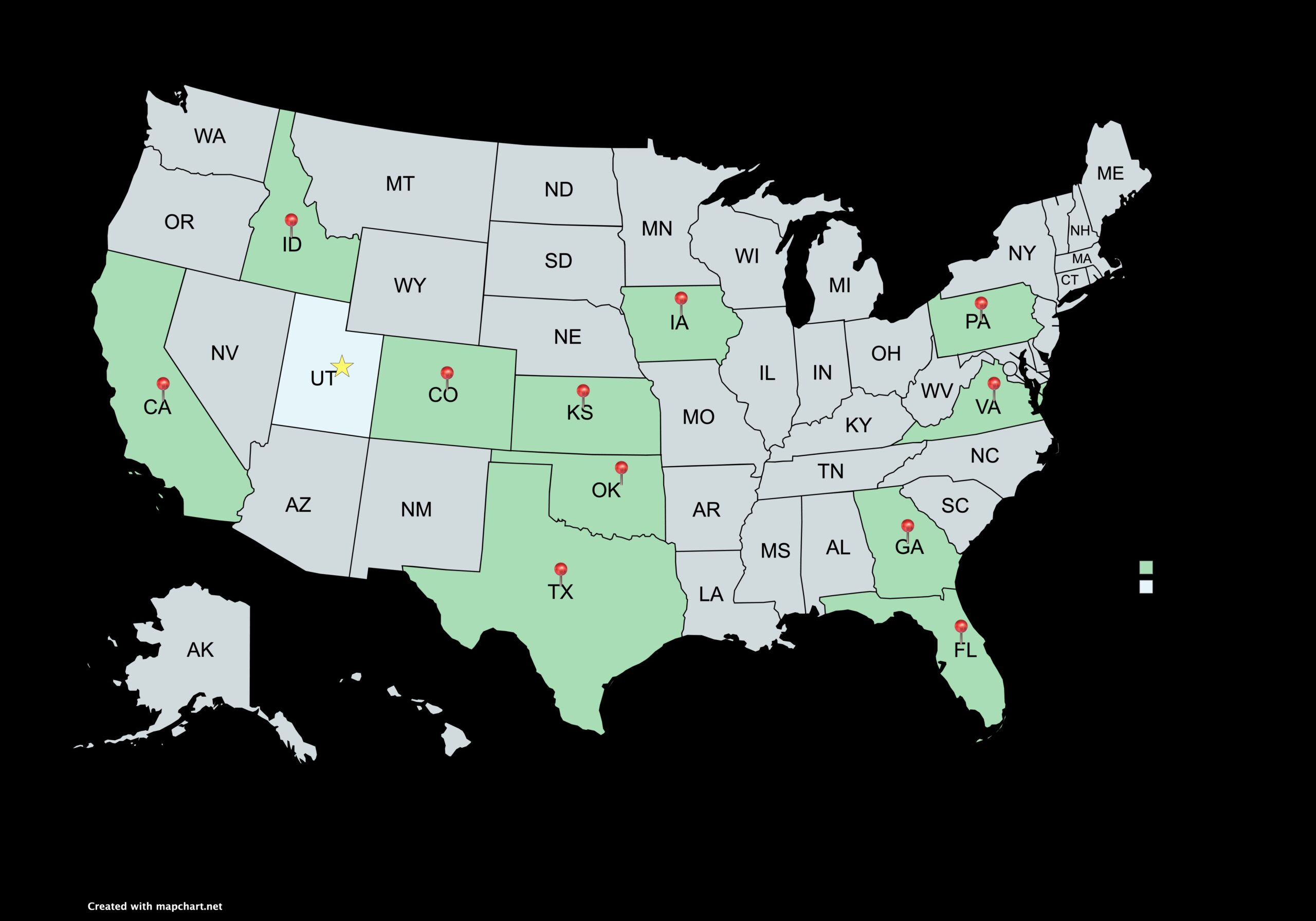

VA OTC Construction Loans

Everything You Need to Know About the VA OTC Construction Loan Building your dream home as a veteran or active-duty service member is more accessible than ever, thanks to the VA One-Time Close (OTC) Construction Loan. Whether you already own land or are starting from scratch, this loan option offers a streamlined path to homeownership—with… Continue reading VA OTC Construction Loans

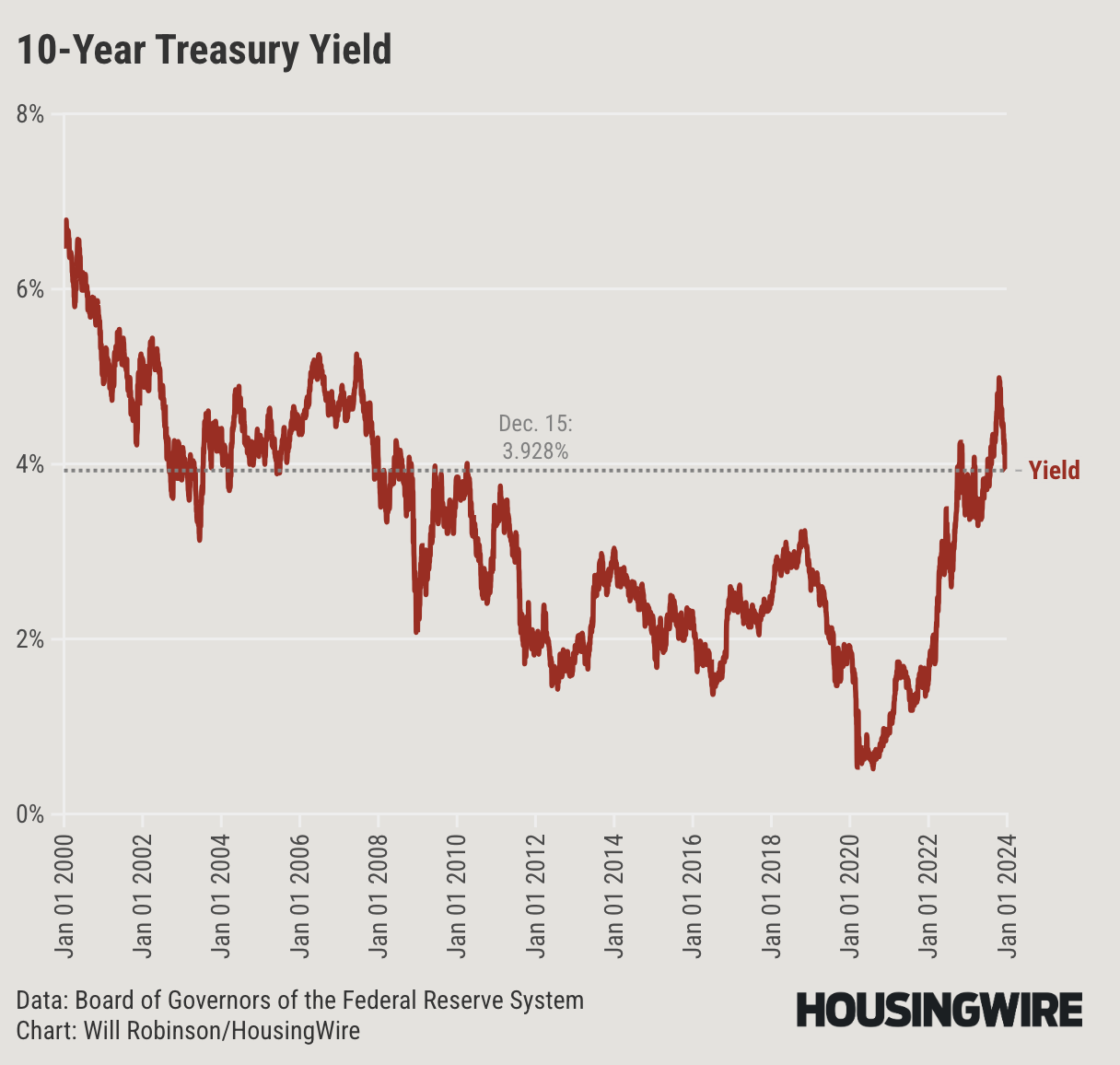

🚫 Why the FED Rate Cut isn’t Lowering Mortgage Rates

Understanding the Disconnect: FED Rate Cuts and Mortgage Rates For many homebuyers, navigating the current mortgage landscape can feel like walking through a maze. Recent Federal Reserve rate cuts have raised confusion, especially when they don’t always lead to lower mortgage rates. Here’s a quick breakdown to help clarify what’s happening. 1. FED Cuts ≠… Continue reading 🚫 Why the FED Rate Cut isn’t Lowering Mortgage Rates

A Positive Outlook for Buyers and Renters

In the optimistic landscape of 2024, Zillow economists foresee several encouraging trends in the housing market: 1. Abundance of Homes on the Market: Homeowners, understanding that mortgage rates are unlikely to decrease significantly soon, are anticipated to list their homes for sale. Those who secured long-term payments at historically low rates in 2021 may decide… Continue reading A Positive Outlook for Buyers and Renters

Charting the Course

As the countdown to 2024 begins, all eyes are on the pivotal decisions of the Federal Reserve and their potential ramifications for investors. In the aftermath of the most recent meeting earlier this month, the Fed announced its intention to implement three interest rate cuts in the upcoming year, coupled with an optimistic outlook for… Continue reading Charting the Course

Economic Waters

In a pivotal decision at its final policy meeting of 2023, the Federal Reserve opted to maintain interest rates within the 5.25% to 5.5% range for the third consecutive meeting. While the rates remained unchanged, the central bank hinted at a potential shift in strategy for 2024, suggesting the likelihood of significant rate cuts. This… Continue reading Economic Waters