Happy New Year! As we head into 2026, I want to start by saying thank you to everyone who trusted me with their mortgage in 2025 or prior years. 2025 was a great year — we helped over 60 borrowers, including 19 new construction home loans, and I’m incredibly grateful for the relationships built along the way. We offer… Continue reading Happy New Year! Strong Starts, Stable Rates & VA Construction Opportunities

Tag: mortgage broker

VA OTC Construction Loans

Everything You Need to Know About the VA OTC Construction Loan Building your dream home as a veteran or active-duty service member is more accessible than ever, thanks to the VA One-Time Close (OTC) Construction Loan. Whether you already own land or are starting from scratch, this loan option offers a streamlined path to homeownership—with… Continue reading VA OTC Construction Loans

🚫 Why the FED Rate Cut isn’t Lowering Mortgage Rates

Understanding the Disconnect: FED Rate Cuts and Mortgage Rates For many homebuyers, navigating the current mortgage landscape can feel like walking through a maze. Recent Federal Reserve rate cuts have raised confusion, especially when they don’t always lead to lower mortgage rates. Here’s a quick breakdown to help clarify what’s happening. 1. FED Cuts ≠… Continue reading 🚫 Why the FED Rate Cut isn’t Lowering Mortgage Rates

Are You Mortgage-Ready?

Are You Mortgage-Ready? What Renters Need to Know As the housing market evolves, many renters may not realize that they are closer to homeownership than they think. A recent article, “Some renters may be ‘mortgage-ready’ and not know it. Here’s how to tell,” sheds light on this topic and offers valuable insights for those currently… Continue reading Are You Mortgage-Ready?

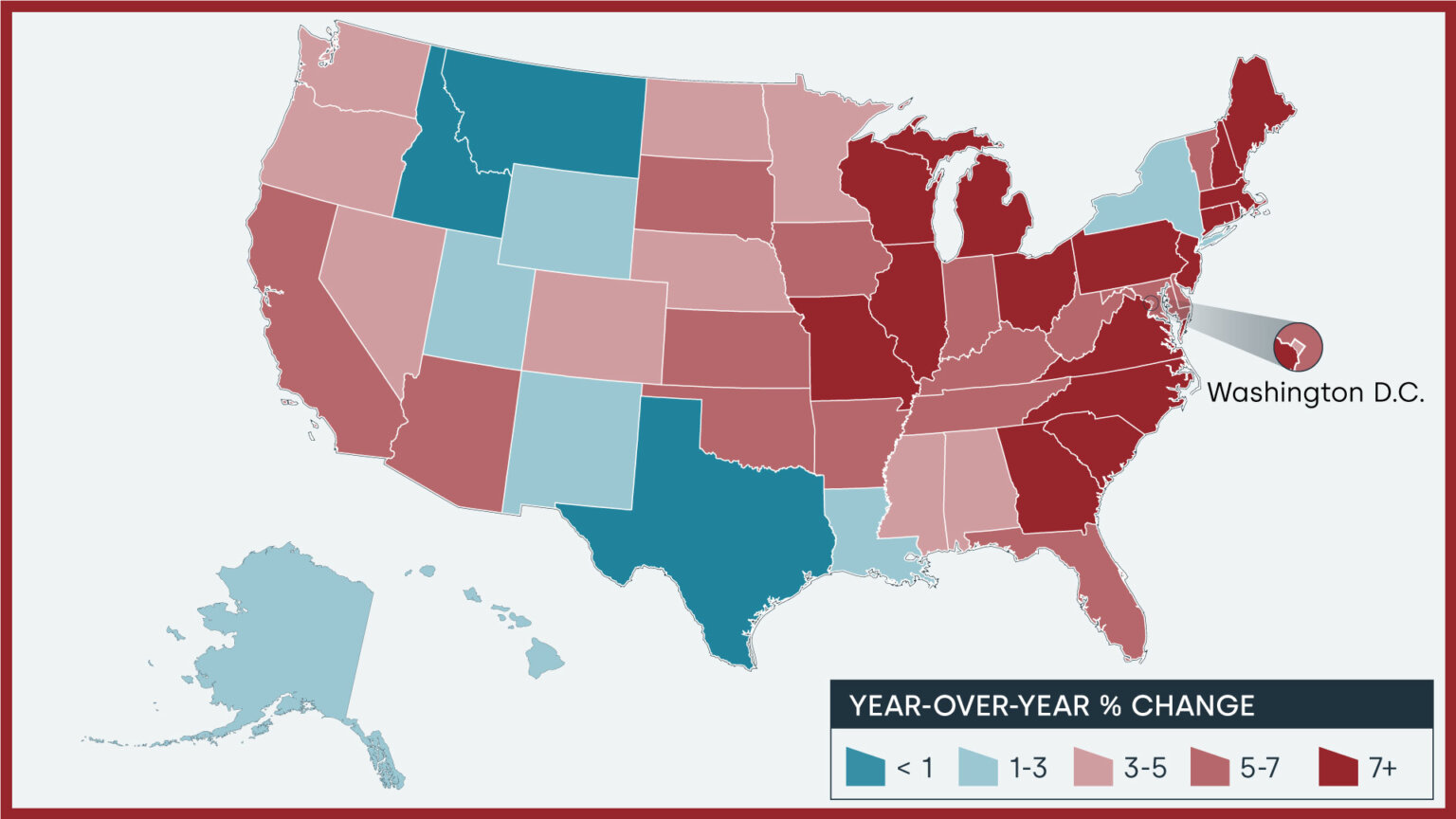

Are Housing Prices Declining?

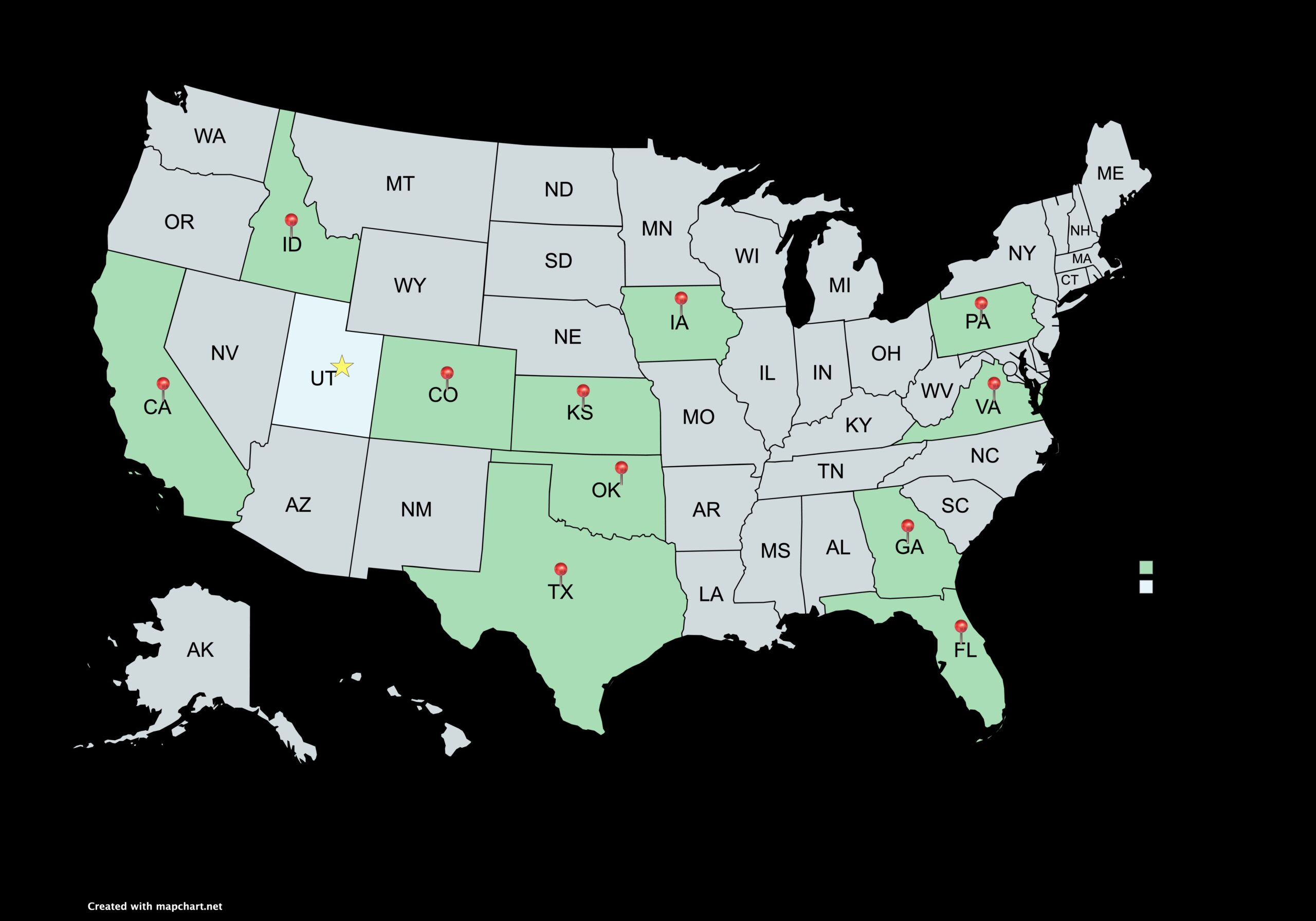

Source: Corelogic

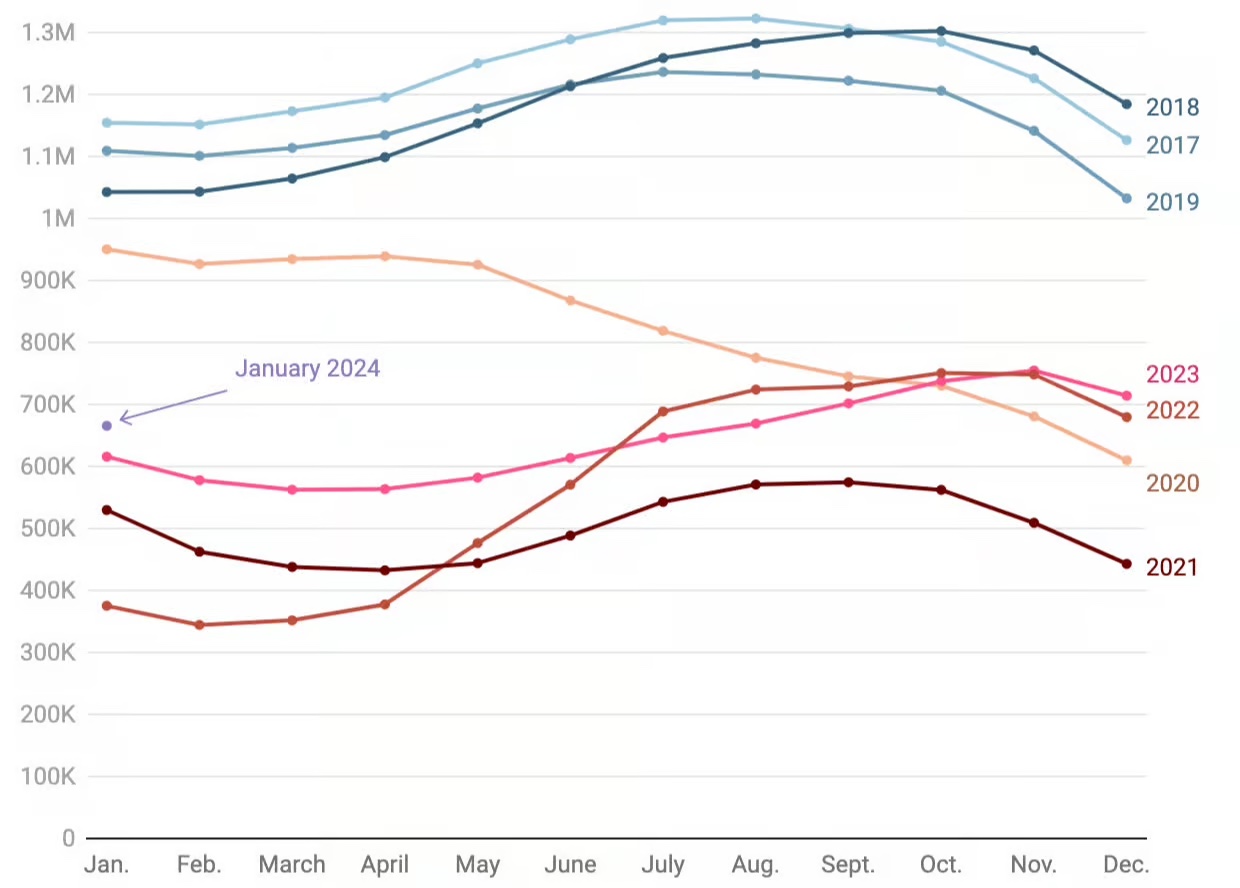

Real Estate Market Snapshot

As we step into the new year, the real estate market in January 2024 exhibited notable trends and shifts, revealing a dynamic landscape for both buyers and sellers. Let’s delve into the key statistics that shape the current state of the housing market. Active Listings Surge: In January 2024, Realtor.com reported a total of 665,569… Continue reading Real Estate Market Snapshot

Gift Funds for Your Home Purchase

Using gift funds for a primary home purchase is a common practice, and many lenders allow it. Gift funds are funds given to you by a family member, friend, or other eligible source to help you with the down payment or closing costs. Here are some key points to consider: 1. Gift Letter: Most lenders require… Continue reading Gift Funds for Your Home Purchase

A Positive Outlook for Buyers and Renters

In the optimistic landscape of 2024, Zillow economists foresee several encouraging trends in the housing market: 1. Abundance of Homes on the Market: Homeowners, understanding that mortgage rates are unlikely to decrease significantly soon, are anticipated to list their homes for sale. Those who secured long-term payments at historically low rates in 2021 may decide… Continue reading A Positive Outlook for Buyers and Renters

Reflecting on the Journey

As we stand on the cusp of a new year, it’s only natural to reflect on the journey we’ve traversed through 2023 and the promise that 2024 holds. This moment marks not just the transition of time but also an opportunity to acknowledge the collective experiences that have shaped us. The passing year, with its… Continue reading Reflecting on the Journey

Charting the Course

As the countdown to 2024 begins, all eyes are on the pivotal decisions of the Federal Reserve and their potential ramifications for investors. In the aftermath of the most recent meeting earlier this month, the Fed announced its intention to implement three interest rate cuts in the upcoming year, coupled with an optimistic outlook for… Continue reading Charting the Course